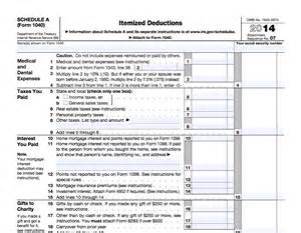

via IRS.gov

Recently my Twitter feed seems to be more and more full of what I might euphemistically call “current events,” while conversations about philanthropy have been taking a back seat. However, one particular Forbes article has been making the rounds on Twitter: the January 31, 2017, piece by Ashlea Ebeling entitled “This May Be The Last Year You Get A Charitable Tax Deduction.”

This article correctly notes that proposed legislation:

could decimate giving and cut the number of Americans who can claim the charitable tax deduction by 80% to just one out of 20 taxpayers…. The charitable tax deduction would still be part of the tax code—that way politicians can say they preserved it—but way fewer taxpayers would get to claim it.

These changes are outlined by the Republican Party’s Tax Reform Task Force in “A Better Way – Tax.” Deductions like those for charity, taxes, mortgage interest, and medical payments will persist; rather than eliminate them, A Better Way would nearly double the standard deduction, eliminating the need or desire to itemize for most taxpayers:

But just as importantly, because of the other provisions included in the new tax system, far fewer taxpayers will choose to itemize deductions, with the vast majority of taxpayers finding they are better off by taking advantage of the larger, simpler standard deduction instead.

In other words, many taxpayers could still qualify for the charitable tax deduction, but there will be no incentive to take it. With the larger standard deduction, the paperwork and record-keeping will be easier, and the financial advantage of itemizing have disappeared.

Past IRS data backs this up (aggregated IRS data can be downloaded from their website).

In 2014, IRS data reveals that 30% of taxpayers chose to itemize on their returns. Examining itemized deductions by income level in 2014 shows that it is at the $100,000-$200,000 adjusted gross income (AGI) level that average total itemized deductions first exceed the proposed new standard deduction of $24,000 (for married filing jointly). In 2014, 77% of taxpayers at this income level itemized; with a $200,000 AGI or above, more than 90% of 2014 taxpayers itemized, and above $10M fully 97% itemize. In 2014, 15.97% of taxpayers reported an AGI above $100,000, and just 4.19% reported an AGI above $200,000.

The available IRS data does in fact suggest that the charitable deduction, along with the mortgage interest deduction, state tax deduction, and other miscellaneous deductions will no longer make financial sense for anywhere from 14% to 26% of taxpayers who currently itemize.

Compounding the impact of the higher standard deduction, there are reports that President Trump favors a $100,000 (single filers) to $200,000 (married filers) cap on itemized deductions. Looking at that same IRS data from 2014, average total deductions exceed the $100,000 limit for taxpayers with AGIs of $1M, and surpass the $200,000 limit for those with AGIs of $1.5M or more.

So how important is the tax deduction in charitable decisions? Certainly, any of us who have ever worked in gift processing will attest to the urgency of year-end giving, which is likely driven by the convergence of tax deadlines with the holidays. How many of us have had to work every New Year’s Eve, puzzle over gift dates as the calendar changes, or reprint acknowledgement letters as April 15th approaches?

Moving beyond purely anecdotal experiences, Giving USA data, as cited by Independent Sector, and in highlights posted on Double the Donation’s website, suggests that itemized charitable gifts not only make up more than 80% of total giving, but that itemized gifts are growing at a faster rate year-over-year than non-itemized gifts.

Federal income tax and the Form 1040 became a part of everyday life in the U.S. with the passing of the 16th Amendment in 1913. The charitable deduction was incorporated into tax regulations four years later, 100 years ago this year.

On February 16, 2017, nonprofit leaders representing CASE, AFP, Independent Sector, and many other associations converged on Capitol Hill for D.C. Fly-In Day to urge lawmakers to work to preserve the charitable deduction. One proposal would add the charitable deduction to the “above the line” calculation of AGI (where things like IRA deductions, education deductions, and self-employment tax deductions live today). In the current political climate, we will need to wait and see if these proposals have any traction. The organizations will be sending out calls to action to their members as things develop.

So how might all of this influence fundraising? Will the GOP tax changes “decimate giving?” What will happen with direct mail and the annual fund? Will we see a growth in crowdfunding and third party fundraising, as attributing and acknowledging gifts to donor names is no longer a tax necessity for most? And what might be the impact on major gifts – the very people for whom it will probably still make sense to itemize?

If rumors of its death are premature, what will the charitable deduction look like a year from now? 100 years from now?

Well-explained, Sarah. It seems many donors give for the sake of giving and not always for the tax deduction, although it’s always an added incentive! Where I am, there was a movement to change legislation to include private company gifts of securities, but it didn’t happen. Does it mean the government is less supportive of the charity sector globally? (Thank goodness I’m still Canadian.) PG

Thanks Preeti! I’m not sure there’s any real analysis of how much philanthropy is spurred by the deduction. There’s lots of correlation, but in the current tax climate that makes perfect sense. I guess we might be able to look at causation if the deduction becomes harder to qualify for and is used less. That is, if our data-adverse government maintains access to current and future IRS data. Meanwhile, in prospect research, I can’t think of one time I ever found evidence that a prospect’s motivation was the tax deduction.